krblokhin/iStock Editorial via Getty Images

Investors are very aware of the AI bubble this year, but there’s one other sector that’s getting a lot less attention but seeing significant market gains this year: fast-casual food chains. Industry titan Chipotle (CMG) is up nearly 30% this year after a massive 50-for-1 stock split; while new IPO CAVA (CAVA) has slightly more than doubled year-to-date as investors cheered the company’s pace of store expansion with its considerable IPO funds.

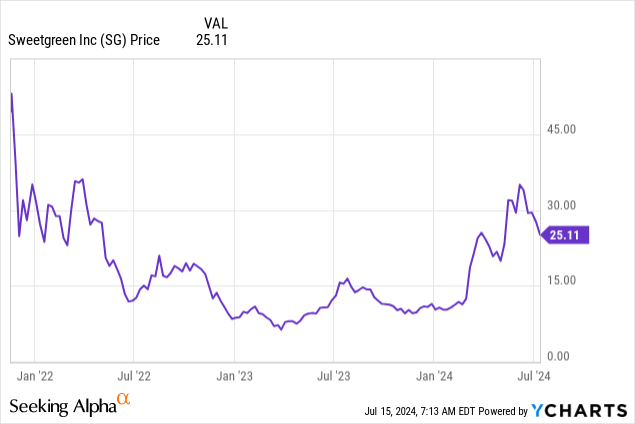

And yet one name is leading the pack: Sweetgreen (NYSE:SG), the fast-casual salad concept, which has seen its share price surge more than 120% year to date. Sweetgreen’s success in the stock market this year isn’t just an expression of strong business performance, but a bet on the company’s future as it automates more of its store fleet with robotics.

Data by YCharts

Data by YCharts

Despite my general aversion to high-flying momentum stocks, I’m initiating Sweetgreen at a buy rating.

To me, there are two main factors that make Sweetgreen stand out versus its fast-casual competitors:

Automation potential. Sweetgreen was relatively early in developing a plan not just for automated ordering systems, but robotic salad-making as well. Though these are costly upfront endeavors, Sweetgreen’s investments can yield tremendous savings in restaurant operating costs over time. Respectable same-store sales growth, and higher food margins versus peers. While rival CAVA is seeing a sharp deceleration in same-store sales growth, Sweetgreen is expecting mid-single digit same-store sales growth this year. Perhaps more than any other fast-casual restaurant, Sweetgreen benefits from healthy food eating trends. We note as well that Sweetgreen’s margin on raw food inputs is slightly higher than peers.

We note that the stock is down ~20% from year-to-date highs above $30, technically putting Sweetgreen in bear market territory. Though I wouldn’t bet the proverbial farm on this stock, I believe Sweetgreen is very deserving of a small position in your portfolio.

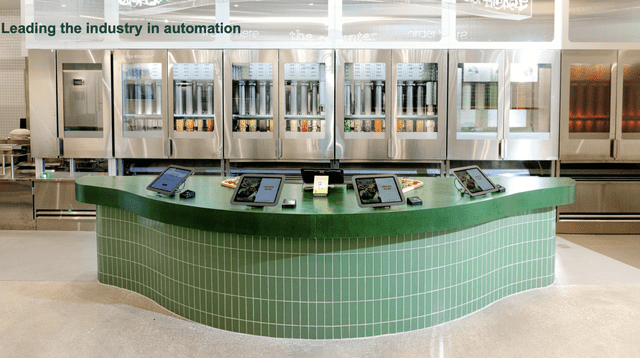

Automation push

You’ve probably seen your neighborhood McDonald’s (MCD) convert to digital ordering towers, though it’s still very possible to go up to the counter and give your order to the cashier in person. Sweetgreen, however, is taking automation one step further than just the ordering process: it has designed robots to automate the salad-making process as well.

Sweetgreen automation graphic (Sweetgreen June 2023 investor presentation)

The company opened its first fully automated location in May 2023, in Naperville, Illinois. The company’s automated system is branded as “Infinite Kitchen,” and has the capacity to produce up to 500 salad bowls per hour. After a customer places an order, the Infinite Kitchen immediately begins assembling their chosen dish. A mechanical platform rotates the salad bowl as the system drops individual ingredients, toppings, and dressings into the bowl.

At the moment, labor is 29% of Sweetgreen’s revenue (as of its most recent quarter). Needless to say, cutting down on restaurant labor over time is a very attractive margin accretion catalyst, especially in a business where restaurant-level operating margins are only in the high teens. But it’s not just labor savings that make automation attractive: if executed successfully, the customer experience improves as well, in particular by bypassing the wait time for mobile order pickups.

On Sweetgreen’s recent Q1 earnings call, CEO Jonathan Neman noted that its first few Infinite Kitchens are generating 10 points of operating margin benefit relative to the other restaurants in the company’s portfolio. The company is planning to broaden its automation this year:

At the end of the first quarter, the two Infinite Kitchens located in suburban trade areas are tracking to an average year, one average unit volume of $2.6 million, and they delivered an average first quarter margin of 28%, 10 points above the fleet average, giving us confidence in our go-forward deployment strategy.

They also continue to demonstrate additional benefits to our operating model, such as faster throughput, better order accuracy, portion in consistency and substantially lower team member turnover. Additionally, we continue to see higher average checks than the markets they operate in.

In 2024, we remain on track to open approximately seven new Infinite Kitchen restaurants as well as retrofit three to four large urban restaurants with the Infinite Kitchen. Our first retrofit will be in New York City this summer. In 2025, we plan to deploy an increasing number of new restaurants powered by the Infinite Kitchen. As we build our future real estate pipeline, we see tremendous white space opportunities across the United States in both new and existing markets.”

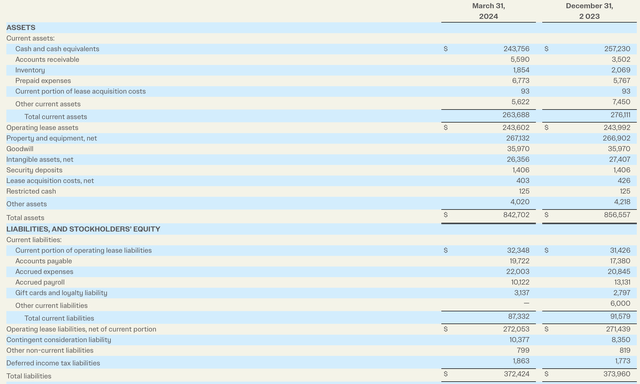

Each retrofit costs between $450,000-$500,000 to execute. It’s comforting to know, then, that Sweetgreen has a sizable cash reserve of $243.7 million as of its most recent balance sheet, which is unencumbered of debt.

Sweetgreen balance sheet (Sweetgreen Q1 earnings release)

Healthy same-store sales growth and margin potential

Put aside the automation potential for a minute, and we still find that Sweetgreen’s execution and fundamental results today are attractive when compared versus peers.

The metric that I lean on most in terms of brand success is same-store sales growth, which measures growth per location, stripping out the impact that new restaurant expansions have on revenue growth.

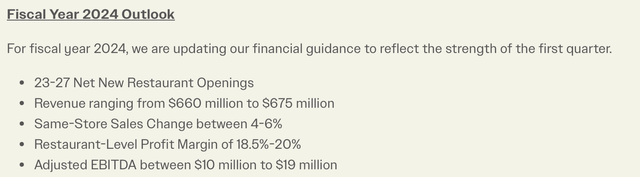

For FY24, Sweetgreen is guiding to same-store sales growth of between 4-6% y/y, and its same-store sales growth in Q1 also clocked in at the midpoint of that range, 5% y/y. We do note that part of this increase owes to pricing, as Sweetgreen rolled out higher menu pricing this year (in line with many industry peers).

Sweetgreen outlook (Sweetgreen Q1 earnings release)

The company has already noted that Infinite Kitchens help to boost average ticket prices, so the company’s plans to retrofit a portion of its store fleet with automation may help to boost same store sales further.

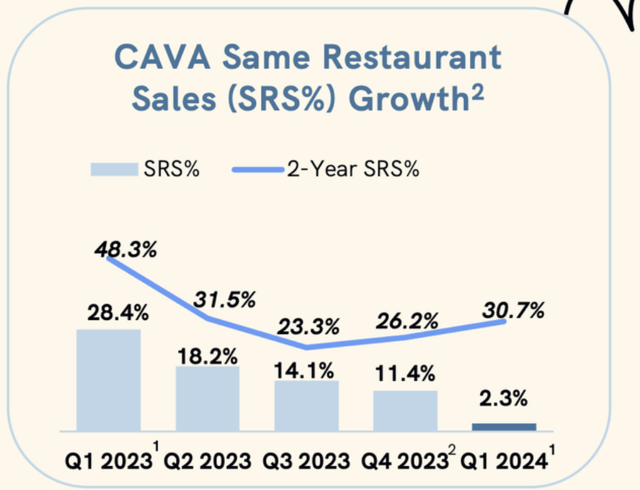

We note that this compares quite favorably to CAVA, which I have a bearish opinion on. Though CAVA is also guiding to ~5% same-store sales growth this year, we note that the company’s SRS decelerated sharply to 2.3% in its most recent quarter.

Cava SRS deceleration (Cava Q1 earnings release)

Whereas Sweetgreen’s guidance is in line with its actual Q1 results, CAVA’s actual performance in SRS has slipped below what it’s guiding to, which may cause disappointment down the road.

We do note that Chipotle is trouncing both Sweetgreen and CAVA in SRS, having reported a 7.0% growth rate in Q1 and guiding to mid-high single digit growth for the year. This is, however, driven largely as well by higher menu pricing.

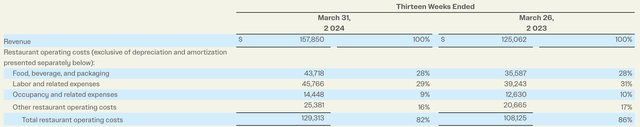

Where Sweetgreen trounces both of these rivals, however, is in its higher food margin. In Q1, for example, the company’s food, beverage, and packaging costs represented 27.7% of its revenue.

Sweetgreen COGS breakdown (Sweetgreen Q1 earnings release)

This compares to 28.6% for CAVA and 28.8% for Chipotle. In a business where restaurant operating margins hover near ~20%, Sweetgreen’s ~100bps advantage in food costs (if you think lunch salads are overpriced, this is an indication that you’re probably right) makes a big difference.

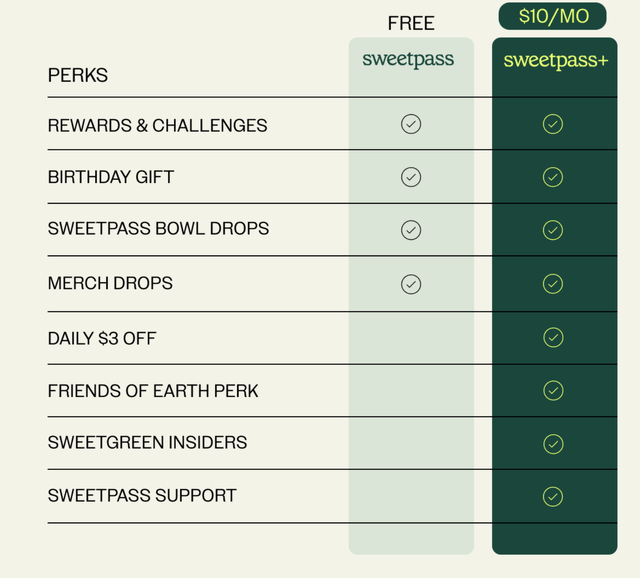

Another area in which Sweetgreen differs from peers: while most restaurant chains offer a loyalty and rewards program, Sweetgreen also has a paid subscription plan called Sweetpass+.

Sweetpass+ (Sweetgreen website)

The key benefit here is $3 in daily salad savings in exchange for a $10/month membership fee. While the company has noted that subscription revenue is not a major revenue driver yet, what it does encourage is habitually within its most loyal customer base.

Risks and key takeaways

Sweetgreen enjoys a healthy same-store sales growth premium above peers like CAVA, and it has a higher food margin as well as ongoing potential benefits from its early investments into automation – which, over time, can help drive a substantial profit margin gap to its peers.

There are risks here, of course. The first main risk is that Sweetgreen is driving healthy revenue growth this year through price increases. In a very inflationary environment, consumers may eventually push back against price increases (especially as salads can be very cheap and easy to make at home).

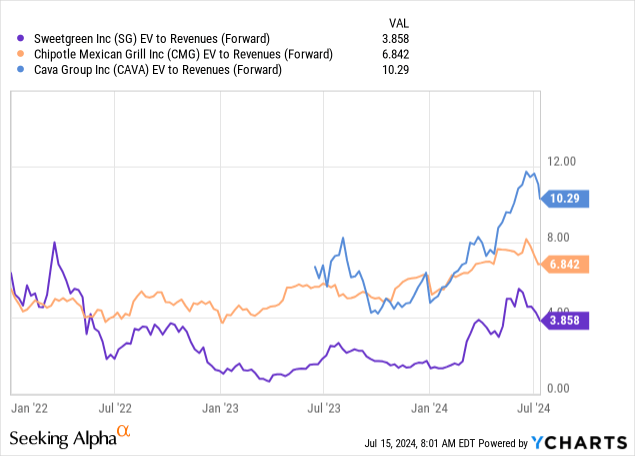

The second risk is valuation: with the restaurant group’s surging share prices this year, we could be due for a bigger clawback of recent gains. I do, however, take comfort in the fact that Sweetgreen trades at a much lower forward revenue multiple (~4x) than its peers:

Data by YCharts

Data by YCharts

All in all, I think there are both attractive near-term and long-term success drivers for Sweetgreen, especially as interest in health trends continue to grow. Take this near-term dip as a buying opportunity.