Feeling blue? You wouldn’t be alone if you use your wallet to combat your sadness. According to the latest LendingTree survey of nearly 2,000 U.S. consumers, 69% of Americans say their emotions have influenced their spending. For many, their window shopping turns into wallet weeping — in fact, 76% of emotional spenders say doing so has led to overspending.

Here’s what else we found.

Many Americans are guilty of letting their emotions drive their spending, and their wallets feel the effects. Almost 70% of Americans admit emotions have influenced their spending habits, with millennials (76%) and Gen Zers (75%) the most likely age groups to say so. Among emotional spenders, stress (50%), excitement (44%) and happiness (38%) are the top feelings that fuel the shopping sprees.

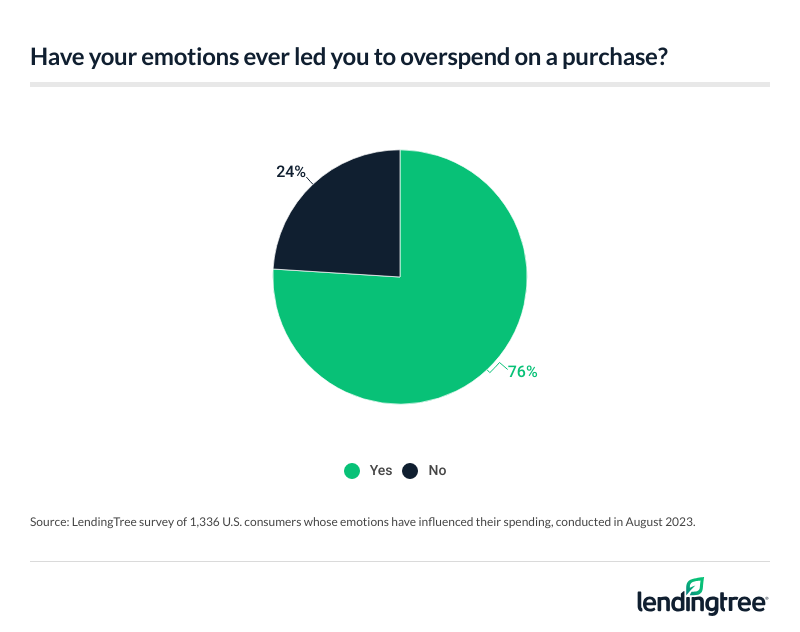

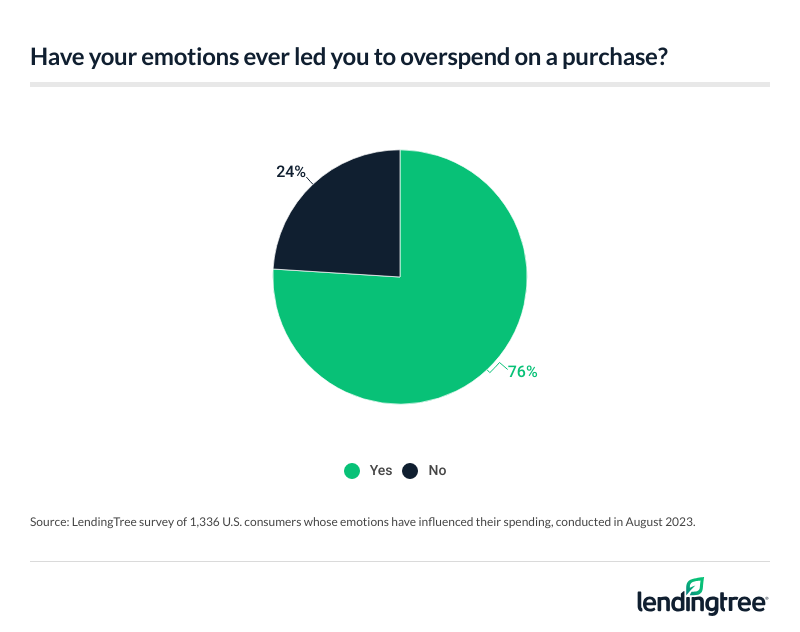

Emotionally charged card swiping leads to regret for some. 76% of emotional spenders admit that doing so has led to overspending, and 39% of them say they’ve gone into debt as a result. This may contribute to why 71% of emotional spenders say they’ve felt guilty or regretful after mood-fueled buying. In addition, 44% say emotional spending has negatively impacted their financial well-being, high among millennials (54%) and women (47%).

Overall, Americans are more likely to spend when they’re in a positive mood — but some still seek retail therapy. Almost half of Americans have made purchases in an attempt to improve their mood, with women much more likely to do so than men (57% versus 40%). When engaging in retail therapy, food (62%), clothing and jewelry (59%), and personal care products (40%) are the top purchases.

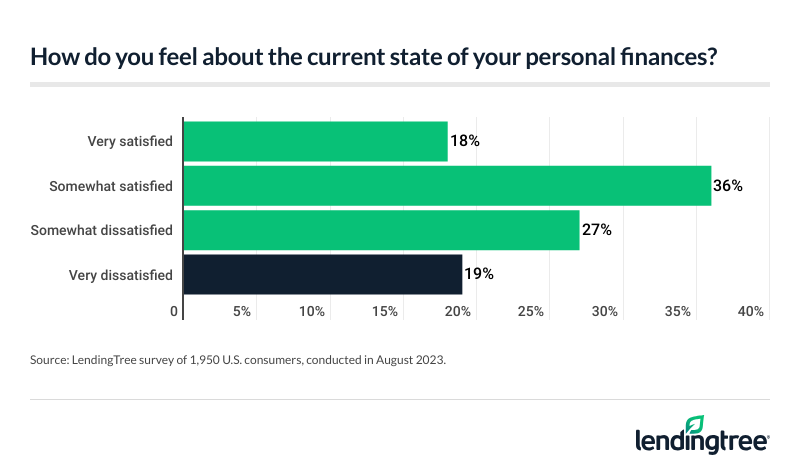

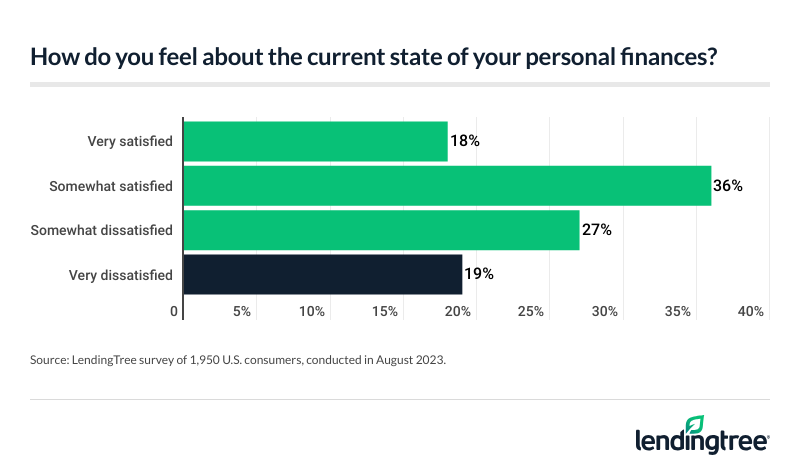

Half of Americans view emotionally driven spending as normal behavior, but cutting back could help improve cash flow. 46% of Americans report being at least somewhat dissatisfied with the state of their finances, with women (53%) and Gen Xers (51%) among the least content. While Gen Zers are the generation most likely to love shopping (47%), they’re also the most satisfied with their finances at 68%.

As the saying goes, money can’t buy happiness — but those who indulge in retail therapy may disagree. In fact, almost 70% of Americans say their feelings have influenced their spending habits. By age group, millennials (ages 27 to 42) are the most likely to spend emotionally, at 76%.

That’s followed by:

Gen Zers (ages 18 to 26) (75%)

Gen Xers (ages 43 to 58) (65%)

Baby boomers (ages 59 to 77) (57%)

According to LendingTree chief credit analyst Matt Schulz, experience is the best teacher when it comes to emotion-driven spending — which may be why younger generations are more likely to admit to it.

“So many people get a little spendy when they get their first real job or big promotion,” he says. “Or maybe they’re sad over a breakup or feeling homesick. Whatever the reason, before long, they find themselves with some debt that can be hard to climb out of. Hopefully it’s a lesson they won’t have to be taught more than a time or two, but that’s not always the case.”

Unsurprisingly, higher earners are more likely to let their emotions influence their spending than lower earners. Americans earning between $75,000 and $99,999 a year lead the pack here, with 3 in 4 (75%) admitting to emotional spending. Meanwhile, Americans earning less than $35,000 (64%) are least likely.

In addition, those with children younger than 18 (78%) are significantly more likely to spend emotionally than those without children (66%) and those with children older than 18 (60%). Women (71%) are also more likely to engage in retail therapy than men (66%).

Among emotional spenders, 50% say stress is the top mood that influences them to spend — the most common response. That’s followed by:

Excitement (44%)

Happiness (38%)

Boredom (37%)

Sadness (32%)

Anxiousness (25%)

Loneliness (20%)

Romance (13%)

Anger (9%)

Fear (7%)

Jealousy (6%)

Other (3%)

None of the above (3%)

Six-figure earners (55%) and Gen Zers (51%) are particularly likely to say excitement influences their spending. In addition, 51% of six-figure earners say happiness is the top influencing emotion — the only demographic to cross the 50% threshold here. Meanwhile, those earning between $35,000 and $49,999 (59%), women (57%) and Gen Xers (55%) are the most likely to say stress is the top mood that drives spending.

But whether driven by emotion or not, the internet makes impulse shopping easier. That’s proven by the 41% who say they make impulse purchases online. Following that, 39% say they typically make their impulse purchases in stores, while 3% say they make purchases through social media. Another 17% say they don’t make impulse purchases.

Americans feel pressured to keep up with the Joneses

Spending to keep up with friends and peers is also prevalent — particularly among younger Americans. While 1 in 5 Americans admit to feeling pressured to spend more to stay on par with their peers, younger generations are overwhelmingly more likely to say so. In fact, 35% of Gen Zers and 29% of millennials say so; in comparison, with 14% of Gen Xers and 3% of baby boomers.

With high-end children’s products available and “momfluencers” on the rise, it may not be surprising that parents with young children also resonate with this sentiment. While 29% of those with children younger than 18 feel pressured to spend more to keep up, just 20% of those without children and 7% of those with adult children say similarly.

Lifestyle creep may also play a factor here, as high earners are more likely to agree than low earners. Those earning between $75,000 and $99,999 (28%) are the most likely income group to share this sentiment, while those earning less than $35,000 (16%) are the least likely.

When the heart shops, the wallet takes a hit. Among emotional spenders, 76% say letting their heart take the card has led to overspending. And many Americans are shopping ’til they drop … into debt. In fact, 39% of emotional spending say they’ve gone into debt as a result of their retail therapy. That’s particularly true among those with children younger than 18 (48%), millennials (44%) and those earning between $50,000 and $74,999 (44%).

Still, Schulz believes debt isn’t the only consequence of emotional spending.

“When your emotions are driving your actions, it can be hard to get either of them under control,” he says. “When your spending is out of control, things can get dicey quickly. Regularly spending emotionally can lead to damaged credit scores if you’re unable to make payments. It can lead to reduced self-esteem if you constantly beat yourself up over your spending struggles. It can ruin relationships if it leads to keeping secrets from your loved ones. And that’s just a few examples.”

As proven by this, 71% of emotional spenders say they’ve felt guilty or regretful after letting their emotions drive their purchase.

Of course, splurging regularly has consequences. Among emotional spenders, 44% say doing so has negatively impacted their financial well-being. That’s particularly true for those with children younger than 18 (54%), millennials (54%) and those earning less than $35,000 (48%).

Further, women (47%) are more likely to share this sentiment than men (41%).

Generally speaking, Americans are more likely to consider themselves savers rather than shoppers. While 30% describe themselves as savers, 21% consider themselves spenders and 44% believe they’re both equally.

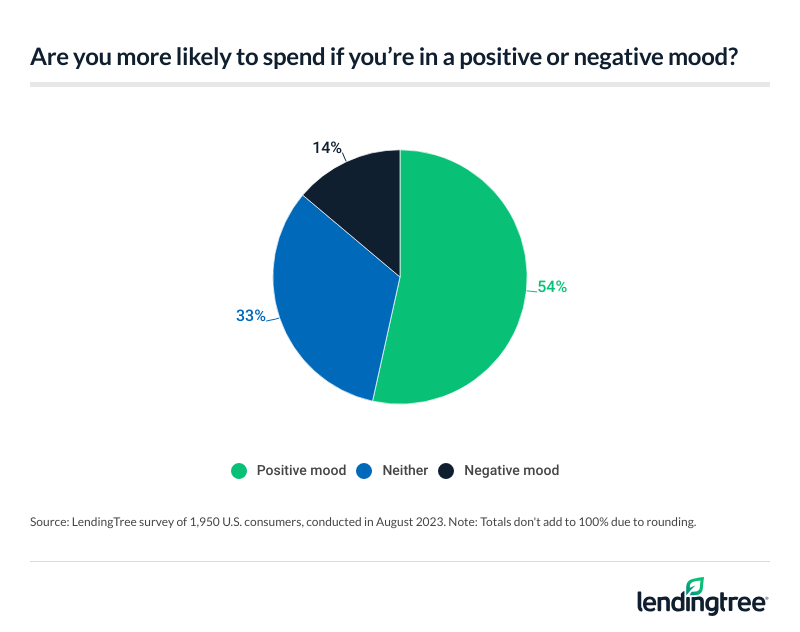

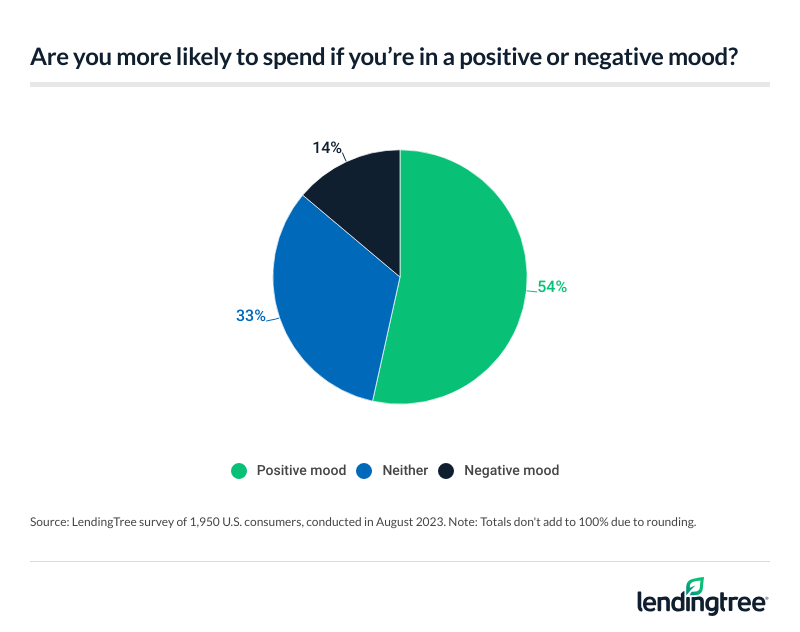

While the term retail therapy suggests emotional spending is a pick-me-up, Americans are more likely to spend when they’re in a positive mood. Overall, 54% say they’re more likely to spend when they’re in a good mood, while just 14% say they’re more likely to spend when in a negative mood.

Gen Zers (63%), six-figure earners (63%) and parents with children younger than 18 (60%) are the most likely to shop while upbeat. Meanwhile, women (18%), those earning between $35,000 and $49,999 (17%) and millennials (17%) are the most likely to shop while feeling down.

But some still seek retail therapy. Almost half (49%) of Americans have made purchases in an attempt to improve their mood, with parents with children younger than 18 (63%) and millennials (60%) the most likely to do so. In addition, women (57%) are much more likely to buy something as a mood booster than men (40%).

And how often are emotional spenders shelling out? Among these spenders, 22% say their moods often influence their purchases. Meanwhile, 59% say their emotions only sometimes influence them and 17% say it rarely happens.

When they spend, emotional eating is the most common form of retail therapy, with 62% citing food as a typical purchase. Following that, the most common purchases to make while emotional spending are:

Clothing and jewelry (59%)

Personal care products (40%)

Entertainment (33%)

Crafts and hobby products (29%)

Alcohol (28%)

Home-related goods (27%)

Electronics (27%)

Drugs (13%)

Other (4%)

Half (50%) of Americans view emotionally driven spending as normal behavior, but Schulz says that doesn’t mean it’s good for you.

“I think emotionally driven spending is normal behavior,” he says. “That doesn’t mean I think it’s positive or helpful or should be encouraged, but I do think it’s normal in that it’s something that almost all of us do at one time or another. Now, I think we need to normalize people seeking help for managing it because the truth is that emotional spending can wreck more than just a budget.”

Among the potential consequences, emotional spending may influence financial satisfaction. In fact, 46% of Americans report being at least somewhat dissatisfied with the state of their finances.

Low earners are particularly likely to feel dissatisfied: Those earning less than $35,000 are the most likely demographic to feel at least somewhat dissatisfied at 64%. Women (53%), those earning between $35,000 and $49,999 (52%) and Gen Xers (51%) are also among the least content.

With that in mind, it shouldn’t be surprising that not all Americans enjoy retail therapy. In fact, half (50%) say they only like to shop when they have to and just 30% of Americans love to shop. Meanwhile, 14% say they don’t feel strongly about shopping and 6% dislike it.

Notably, while Gen Zers are the generation most likely to love shopping (47%), they’re also the most satisfied with their finances (68%). That trend continues with parents. Of those with children younger than 18, 41% love shopping and 56% are at least somewhat satisfied with their finances — higher than parents with adult children and those without children in both categories (respectively, 17% and 52%, and 29% and 53%).

High earners are also likely to share this sentiment. Among six-figure earners, 38% love to shop. They’re also the income group most satisfied with their finances (77%).

Your feelings shouldn’t always come with a price tag. To help curb emotion-driven impulse spending, Schulz recommends the following:

Seek professional help if you need it. When it comes to our vices, we often can’t get better on our own. “There’s no shame in seeking help for emotional overspending,” Schulz says. “It’s never been easier or more affordable to find counseling. After all, emotional spending usually isn’t about the spending itself. There’s some underlying issue driving it, and professional advice can help you get to the bottom of it.”

Surround yourself with people who can help. “Your friends and family likely want to help you, but they can’t do it if they don’t know there’s an issue,” Schulz says. “It requires a lot of vulnerability and can be scary, but sharing your struggles with your loved ones can lead to an outpouring of support and help that can be invaluable to you as you work to get your emotional spending under control.”

Budgets and lists can set guardrails. “Emotional spending is typically impulse spending, and budgets and shopping lists are simple and effective ways to battle that urge,” he says. “They’re not foolproof by any stretch of the imagination, but just having them can help. For example, making a list before shopping can change the vibe of the trip. You’re no longer browsing, you’re on a mission to find specific things you need. Just that change of mindset can help you avoid impulse buying.”

LendingTree commissioned QuestionPro to conduct an online survey of 1,950 U.S. consumers ages 18 to 77 from Aug. 18-22, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

Generation Z: 18 to 26

Millennial: 27 to 42

Generation X: 43 to 58

Baby boomer: 59 to 77